SAP Business One PE IT tool init consulting AG and Siemens

SAP PE.ONE permanent establishment solution

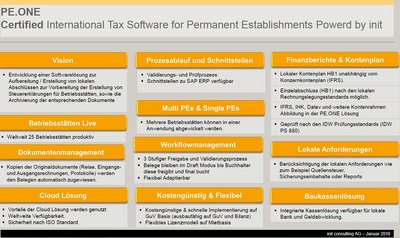

Initial situation – vision of the PE.ONE tool

Together with Siemens AG, the Ingolstadt-based company init consulting AG developed a software solution for permanent establishments based on the Authorized OECD Approach (AOA) and the German Act on Applying the Arm’s Length Principle (BsGaV). The solution incorporates all tax-relevant requirements to make tax returns for permanent establishments quick and inexpensive.

Key facts about the PE.ONE tool

- PE.ONE offers a fair pricing policy with quick and effective introduction

- Low running costs

- Flexible license model

- Evaluation and classification of costs in terms of applicability

- Supports permanent establishments in preparing tax statements

- Local tax regulations are already incorporated and taken into account

- Integration of the local transactions of permanent establishments into global corporate processes

- Integrated workflow management

- Status tracking for workflow activities

- Integrated document management

- Review and validation processes

- Interfaces with SAP/R3

- Option for retrospective manual data entry

- Worldwide access with different authorization levels

- Single-sign-on access

- Flexible / inexpensive / simple

Functionality of the PE.ONE tool

Advantages of the PE.ONE tax solution

- Inexpensive implementation and flexible license model.

- General, subsidiary, and auxiliary ledgers integrated into a single database.

- Modeling of multiple or single permanent establishments.

- Integrated point of sale solution.

- HB1 customization of permanent establishments regardless of the corporate accounting framework.

- The applicability of costs is taken into account.

- Increased data quality thanks to validation and plausibility checks.

- Clean representation of onshore revenues, costs, liabilities, and receivables.

- Local tax requirements are taken into account.

- Retentions, withholding tax, and reporting available in multiple languages.

- Travel documents and other relevant documents are automatically attached to records.

- Financial statements of the permanent establishment are independent of the financial statements of the parent company.

- Cloud solution and web client.

Permanent establishments online

- Egypt

- Iraq baghdad

- Iraq Erbil

- Kingdom of Saudi Arabia

- Qatar

- Jordan

- Lebanon

- Libya

- United Arab Emirates

Contact

Questions about the PE.ONE tool?

You’re welcome to contact us.

init consulting AG

SAP Business One Gold Partner

Ruppertswies 14

85092 Kösching

Germany

Phone: +49(0)8456 27 80 4-0

Fax: +49(0)8456 27 80 4-10

Mail: pe-tool[at]init-consulting[dot]de